Opportunities From Legendary Distilleries Across Scotland

The Scotch Whisky industry alone generated more than USD $7.37 billion in revenue in 2019 and exports continue to grow with the United States market importing over USD $1.47 billion of Scotch in 2019, and other countries across Asia and America seeing outstanding rises in whisky demand. If the demand for scotch whisky continues to grow, which we expect and distilleries struggle to ramp up production to meet that demand, the need for casks of matured liquid will only continue to increase in value across the industry.

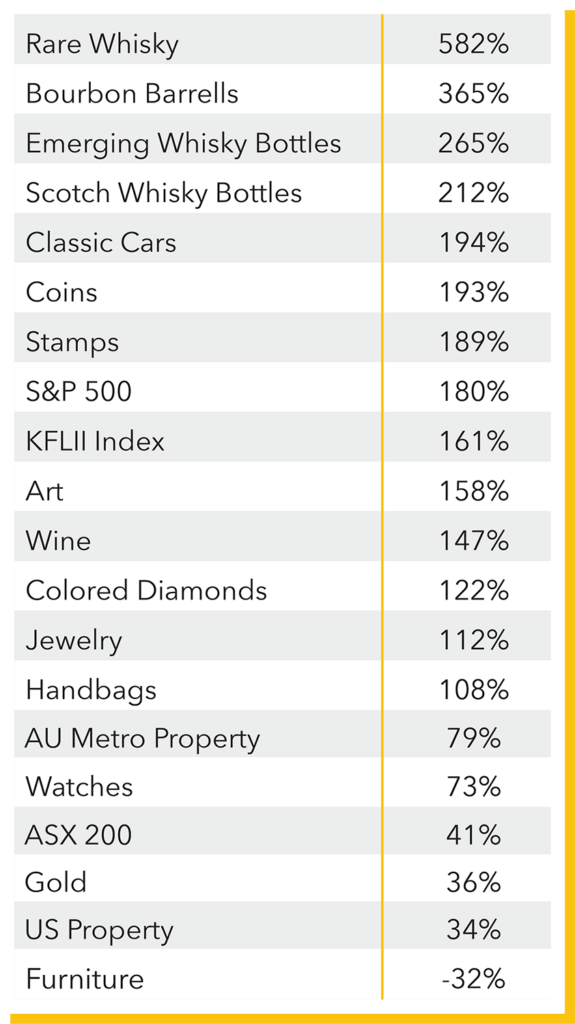

Scotch whisky investment has consistently been recognized as one of the world’s leading tangible asset classes. In the 2019 Knight Frank Wealth Report, an index of the top 100 rare Scotch Whisky bottles was recognized as the leading investment class of the year.

London Irish Whisky Club has access to an extensive inventory of single malt whisky casks from legendary distillers across Scotland. Casks are available from top tier distilleries across all six of Scottish whisky regions. Building a portfolio of Scotch Whisky holdings offers the opportunity to profit from the stable growth of the industry while experiencing the romanticism of the iconic expressions in an entirely new way.

Scotch Whisky has a strict regulatory structure, one which provides a high level of protection for investors. Every cask of whisky that is distilled by a licensed distillery must remain in a government bonded warehouse throughout the maturation process. Records of these casks are maintained by both the warehouse and the HMRC (Her Majesty’s Revenue and Customs). This system ensures that the provenance of each cask can be verified such that any bottle labeled as Scotch can be traced back to its origin.

London Irish Whisky Club ensures that all partner distilleries, warehousing facilities and investment offerings adhere to appropriate legal requirements so that investors are protected to the maximum extent.